The impacts from climate change are already having far-reaching, and perhaps disastrous effects, on natural ecosystems and human livelihoods. Encourage Capital believes that the capital markets must play a critical role in providing incentives for both reducing greenhouse gas emissions and sequestering carbon in biological systems such as forests, grasslands, wetlands, and agricultural systems.

Encourage Capital invests in and is designing ecosystem-based investment strategies to address global climate change. Encourage Capital believes that investing in projects focused on the conservation, restoration and improved management of biological systems — such as forests — is one of the most reliable and most cost-effective ways to address climate change. Such projects also provide co-benefits such as healthier ecosystems that support biodiversity, sustainable wildlife habitat and fresh water.

Encourage Capital has become a leader in financing ecosystem-based carbon offset projects that develop carbon credits for the California carbon market. Our EKO Green Carbon Fund invests in projects that rely on changes in forest management practices that are designed to preserve more carbon. We are also developing investment strategies to support “REDD” projects, which are aimed at reducing tropical deforestation and forest degradation.

The period from 1983 to 2012 was likely the warmest 30-year period of the last 1,400 years in the Northern Hemisphere. –IPCC

The California carbon cap-and-trade market, which uses a market-based mechanism to lower greenhouse gas emissions, is several years into implementation, notably without any measurable drag on the economy. Under a cap-and-trade system, covered companies must hold enough emission allowances to cover their emissions, and are free to buy and sell allowances and offsets on the open market. Through our EKO Green Carbon Fund (GCF), we have invested in land-based carbon projects that will generate carbon offset credits marketable to carbon-emitting entities covered under California’s regulation. One of the most important investments by the GCF is an investment in the development of a project with the White Mountain Apache Tribe (WMAT).

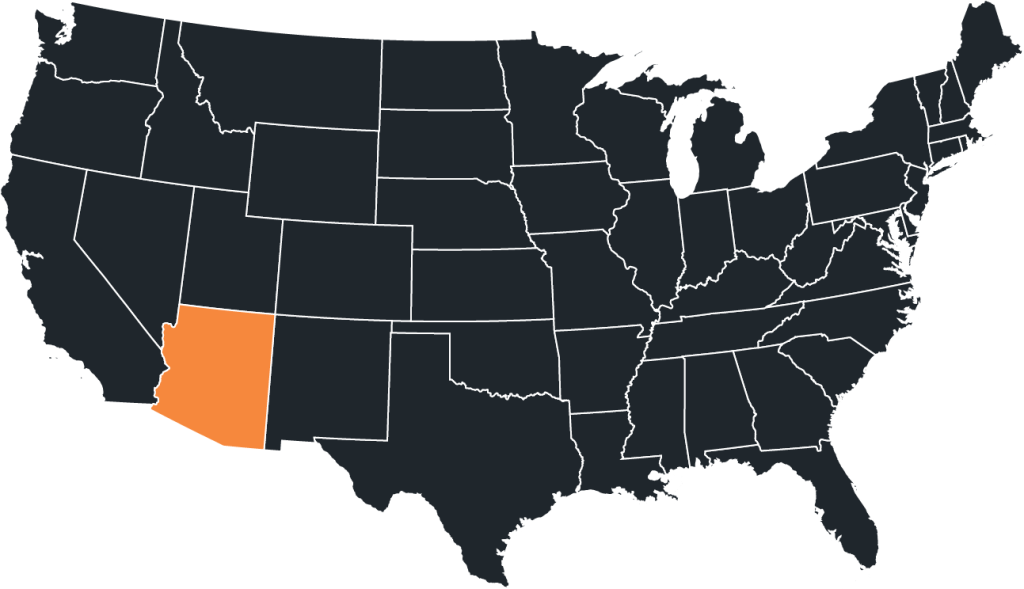

The project is an Improved Forest Management (IFM) project covering 89,000 acres on the Fort Apache Indian Reservation in Arizona. IFM projects seek to protect existing forestland, which both reduces carbon emissions from timber harvesting activity and sequesters carbon out of the atmosphere. Such projects also improve biodiversity and water quality. The WMAT IFM project is the GCF’s largest investment and is expected to produce over 3,500,000 California Carbon Offsets, making it one the largest forest carbon projects in the U.S. While we are pleased with the financial return that it will generate, we are particularly pleased with the environmental impact it will have in securing greenhouse gases from the atmosphere and the extraordinarily positive impact it will have on the White Mountain Apache Tribe, a tribe that has been challenged with extremely high unemployment and poverty.